The Inflation Reduction Act (IRA) offers homeowners in New Jersey and Pennsylvania unprecedented opportunities to upgrade their homes with energy-efficient technology. Whether you’re looking to install a heat pump, add insulation, or invest in renewable energy, Princeton Air is here to help you take full advantage of these incentives while improving your home’s comfort, energy efficiency, and performance.

What is the Inflation Reduction Act?

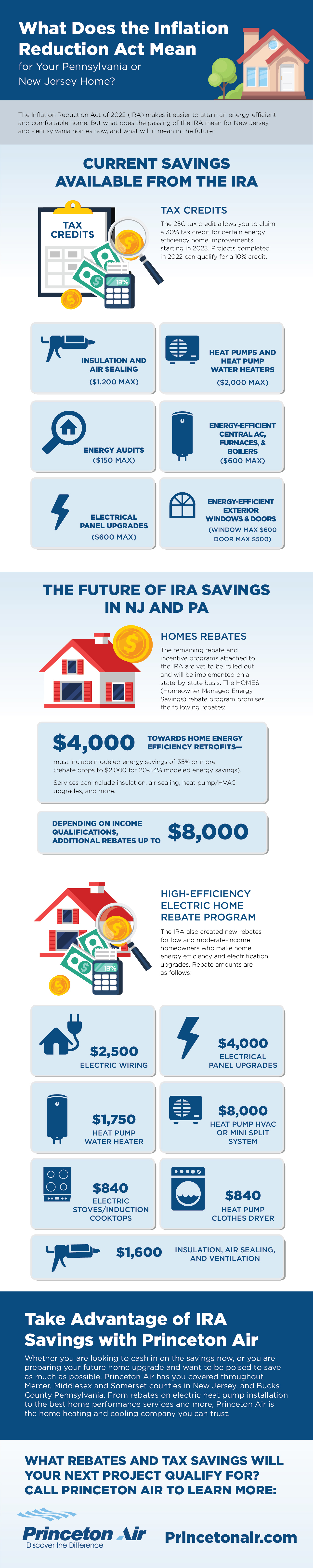

The Inflation Reduction Act (IRA) is a groundbreaking federal initiative designed to make clean energy and energy-efficient home improvements more accessible and affordable. It is the largest climate-focused investment in U.S. history, offering enhanced tax credits and rebate programs for homeowners and businesses.

What Are Tax Credits & Rebates?

- Tax Credits: A federal tax credit reduces the amount of federal income tax you owe. IRA tax credits are nonrefundable, meaning they lower your tax bill but won’t provide a cash refund for unused portions.

- Rebates: IRA rebates are point-of-sale discounts that reduce costs upfront. While specific details for New Jersey and Pennsylvania are still being finalized, these programs are expected to roll out in 2025.

Inflation Reduction Act Tax Credits

Energy Efficient Home Improvement Tax Credit

The Energy Efficient Home Improvement Tax Credit (25C) allows homeowners to save up to 30% of the cost of qualifying upgrades, with an annual cap of $3,200 through 2032. Eligible improvements include:

- Up to $2,000 annually for:

- Heat pumps (ducted and ductless mini splits)

- Heat pump water heaters

- Up to $1,200 annually for:

- Insulation and air sealing ($1,200 max)

- Energy-efficient furnaces and boilers ($600 max)

- Central air conditioners ($600 max)

- Energy-efficient water heaters ($600 max)

To claim these credits, file IRS Form 5695 with your annual tax return.

Residential Clean Energy Tax Credit (25D)

The Residential Clean Energy Credit provides a 30% federal tax credit with no annual cap for solar energy systems and geothermal heat pumps. Unlike the 25C tax credit, unused portions of the 25D credit can roll over to the next tax year, making it a great long-term investment for homeowners.

Inflation Reduction Act Rebates

Two major rebate programs are part of the IRA and are expected to roll out in New Jersey and Pennsylvania in 2025. These rebates will be administered by state agencies and are designed to make energy-efficient upgrades even more affordable.

HOMES Rebate Program

The Home Owner Managing Energy Savings (HOMES) program provides rebates based on the actual or modeled energy savings achieved through upgrades.

- Rebates range from $2,000 to $8,000, depending on the energy savings achieved.

High-Efficiency Electric Home Rebate Program

The High-Efficiency Electric Home Rebate Program offers up to $14,000 in rebates for low- and moderate-income households to electrify their homes. Eligible upgrades include:

- Heat pumps

- Heat pump water heaters

- Electric stoves

- Upgraded electrical panels

Note: Homeowners may only participate in one federal rebate program (HOMES or High-Efficiency Electric Home Rebates) and cannot combine these with other federal grants or rebates.

How Rebates Are Being Rolled Out in New Jersey and Pennsylvania

Both states are preparing to implement IRA rebate programs through existing frameworks, such as utility-managed energy efficiency programs:

- New Jersey: Programs will likely integrate with current rebate structures provided by PSE&G, Jersey Central Light & Power, and others.

- Pennsylvania: Similar integrations with PECO programs are anticipated.

Princeton Air will stay up to date on program details and guide you through eligibility and application processes as they become available.

Why Choose Princeton Air?

With over 50 years of experience, Princeton Air is a trusted partner for energy-efficient home upgrades. Here’s why customers in New Jersey and Pennsylvania rely on us:

- Guaranteed Rebates: We work directly with utilities to ensure you receive your incentives.

- Paperwork Assistance: Our team handles all the paperwork to maximize your savings.

- Flexible Financing: Take advantage of 0% financing through On-Bill Repayment Programs (OBR) or Wells Fargo credit plans to make upgrades accessible to any budget.

Start Saving Today with Princeton Air!

Maximize your savings and comfort with Princeton Air. Whether you’re ready to claim IRA tax credits or planning for upcoming rebates, our experts will guide you through every step.

Call 609-454-6329 to contact Princeton Air today and schedule your consultation!